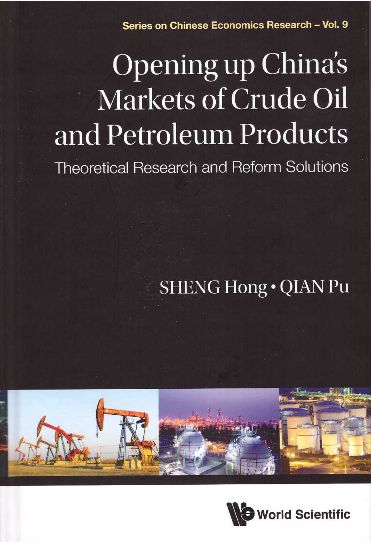

A Theoretical Research and Reforming Solution on

Opening the Markets of Crude Oil and of Petroleum Products

Unirule Institute of Economics

2013年6月25日

基本结论

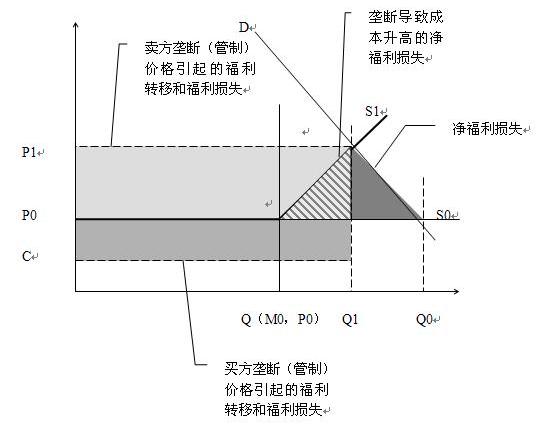

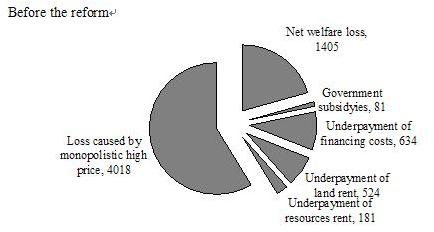

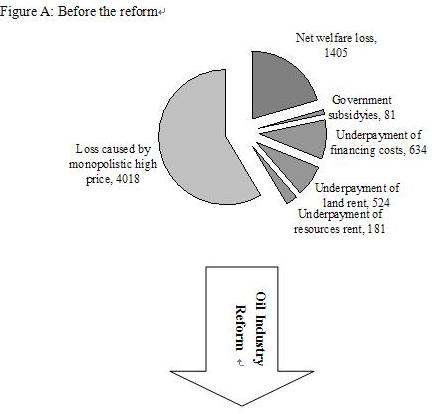

原油和成品油市场放开的改革,是整个石油体制改革的支点和杠杆,它涉及面较小,较之触动石油垄断企业的上游,即采油和炼油阶段的既得利益,相对不那么刚性,却会收取事半功倍的效果。一方面,这一改革能够很快获得打破垄断的大部分好处,即消除了垄断高价给消费者带来的损失,和限制企业进入导致的社会福利净损失。按2011年垄断带来的福利损失计,这一改革可获得石油体制改革的79%或五分之四的静态效果(见下图);并且还会因提高地方炼油企业的开工率而每年增加3000亿元以上的销售额。

原油和成品油市场放开改革的静态效果示意图(亿元)

另一方面,交易领域的市场化改革终将会对处于上游的生产领域产生深远影响,推动我国石油体制改革的最后完成。

这是一个成本很低,但收益很大的改革。

摘 要

石油天然气产业的经济特性,决定了石油天然气产业的体制,应是以市场制度为基础,辅之以政府的恰当介入,包括征收燃油税,对价格过大幅度的波动采取短期的干预,在战时采取对石油资源和产品的征用措施,在和平时期建立储备等等。

我国现有的石油产业体制基本上有三个方面。一是以国有企业为主;一是价格管制,一是限制进入。因而我国石油产业存在着高度垄断。其表现是由两家至三家垄断企业从勘探、开采、炼油、批发和零售,以至进出口的全面垄断。

石油天然气产业的垄断是行政性垄断。即由行政部门通过颁布行政文件设立的垄断。这些行政文件的发布没有经过法律的正当程序,却决定了影响中国人民重大利益的事情,因而是不具法律效力的。

现有石油垄断体制以及由此决定的石油垄断企业的垄断行为,违反了“社会主义市场经济”的宪法原则,也违反了《反垄断法》。设立石油垄断权的行政文件所依据的“道理”没有经济合理性。

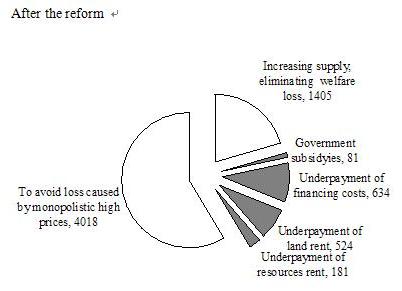

行政性垄断引起的福利损失与分配扭曲示意图

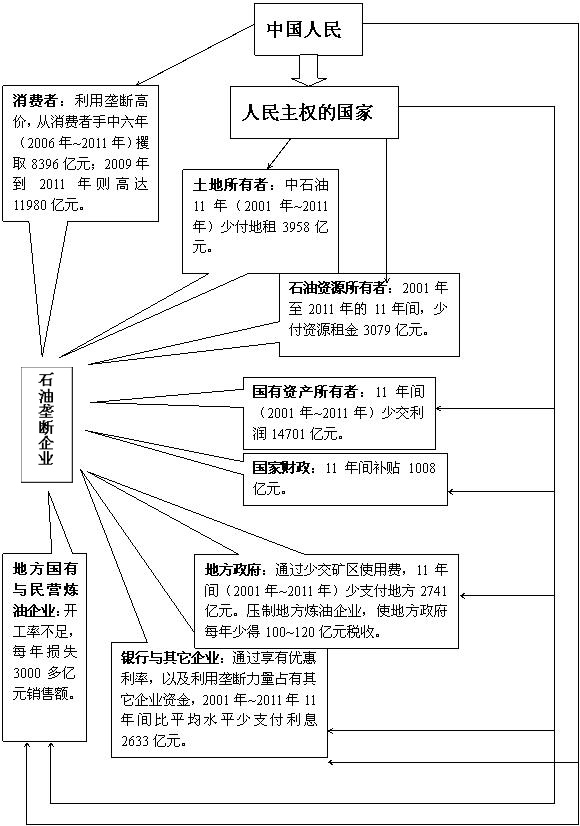

石油垄断体制导致了全社会的巨大效率损失。我们估算,2001年~2011年石油产业的福利损失高达34770亿元。

这一体制还扭曲收入分配,违背公正原则。2000年~2011年,三个垄断石油公司少交的利润高达14701亿元。而在收入水平上,却远高于社会平均水平。如2010年中海油的人均薪酬约34万元,是社会平均水平的10倍左右。

这一体制违背了市场规则。首先是使石油垄断企业成为不公平的竞争者。2001年~2011年,中石油公司共少付土地租金3958亿元。2001年~2011年石油企业少付的资源租金约3079亿元。2001年~2011年石油企业少支付的融资成本约2878亿元。

这一体制使一个本来的竞争性市场变成一个垄断性市场,从而使市场定价机制失效,所以只能由政府管制定价。但这一政府管制的定价机制效率很低。它所定价格必定偏离由市场决定的价格,因而必然带来福利损失。它也使垄断者在价低时减少生产和供给,在价高时过度生产和供给;用产量和库存反过来影响价格。

这一体制还直接损害包括民营企业在内的其它竞争者,包括(1)不许进入,或者将已进入者驱赶出采油和销售等领域;(2)对已经进入石油领域的竞争企业进行限制和歧视;(3)与地方政府联手,利用行政力量排除竞争者;(4)直接侵犯民营企业产权;等等。

通过对原油进口的控制,导致石油垄断企业之外的其它炼油企业开工率严重不足,因此每年损失约3000多亿元销售额。

由于我国成品油的质量标准低于其它主要国家,而北京的成品油质量标准高于全国标准、且接近欧洲标准(见下图),我们以北京的成品油价格做了相应修订后,与其它主要国家的成品油价格平均水平进行比较。

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

欧洲执行标准 |

欧IV标准 |

欧V标准 |

欧V+标准 |

||||

|

北京执行标准 |

欧III标准 |

欧IV标准 |

|||||

|

全国执行标准 |

国II标准 |

国III标准 |

|||||

为了使比较更为公平,我们使用税前价格。北京的成品油价格扣除了消费税和实际增值税。2006年到2011年,我国与其它主要国家的成品油价格(元/升)比较如下:

|

汽油 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

国外加权平均 |

2.30 |

2.57 |

3.06 |

2.18 |

2.64 |

3.38 |

|

国内 |

2.07 |

2.26 |

2.80 |

2.72 |

3.22 |

3.92 |

|

柴油 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

国外加权平均 |

2.33 |

2.54 |

3.50 |

2.13 |

2.64 |

3.52 |

|

国内 |

2.15 |

2.44 |

3.03 |

2.95 |

3.51 |

4.25 |

从2006到2011年,消费者因成品油的垄断(管制)高价的损失高达8396亿元;而从2009年到2011年,我国成品油垄断(管制)价格(税前)持续高于主要国家同品质成品油价格(税前)约31%,消费者的这一损失高达11980亿元。

石油垄断企业攫利图

这一体制还损害国家安全,影响社会稳定。它为石油垄断企业制造“油荒”提供条件和借口;造成中央与地方关系的紧张与对立;造成对中西部地区和和少数民族地区利益的侵害;垄断企业在关键时刻还会要挟政府。

最后,这一体制本身就是对我国宪政框架的违背。垄断企业僭越公权力,行使行政权力或准行政权力;行政部门僭越立法权,并滥用手中的执法权推行行政文件规定的垄断与管制。

因而,这是一个存在重大问题的体制,需要从根本上改革。这一改革具有合宪性,合法性和经济合理性。

石油体制改革的基本目标是:

1、建立一个以市场制度为基础的石油天然气产业体制;

2、建立一个公正有效的石油天然气产业上、中下游的市场竞争格局;

3、政府代表国家竞争性出让石油天然气开采权;

4、政府应在特殊领域特定时期进行有限度的管制。

石油体制改革的基本改革措施是:

1、取消对石油垄断企业的垄断权和部分行政权力;

2、建立超脱和中立的能源产业监管机构;

3、放开石油天然气产业的各个领域;

4、取消价格管制。

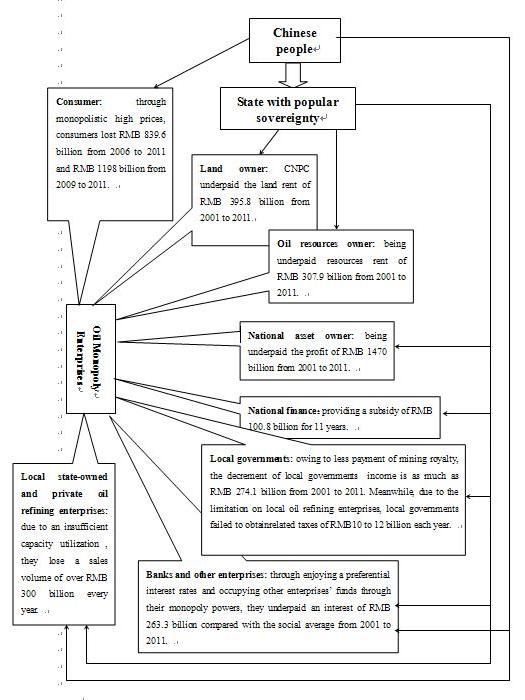

石油体制改革的静态效果示意图(亿元)

A图改革前

原油和成品油市场放开的改革,是整个石油体制改革的支点和杠杆,它涉及面较小,较之触动的石油垄断企业的上游,即采油和炼油阶段的既得利益,相对不那么刚性,却会收取事半功倍的效果。一方面,原油和成品油的市场放开的改革,能够很快获得打破垄断的大部分好处,即消除了垄断高价给消费者带来的损失,和限制进入导致的社会福利净损失。

成品油价格会下降到与国际同等品质成品油的价格水平相同的水平,使广大消费者受益;根据2009年到2011年的数据,我国汽油和柴油的税前价格都可降低约31%,如果消费量与2011年持平,一年可以少支付4018亿元。

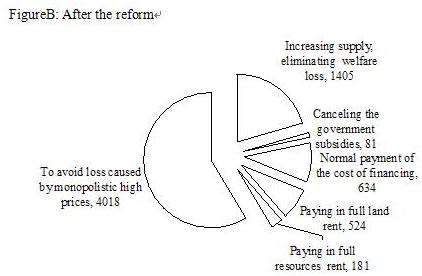

即使根据我国现有的垄断体制外成品油交易中心的价格,在原油和成品油市场放开后,也会出现价格降低的结果。见下图。长三角成品油交易中心的93#汽油价格比发改委管制的价格低约13%。

长三角交易所与发改委汽油(93#)价格对比(2013年2月16日~3月21日,元/升)

按2011年的垄断带来的福利损失计,这一改革可获得石油体制改革的79%或五分之四的效果(见下表);并且还会因提高地方炼油企业的开工率而每年增加3000亿元以上的销售额。

原油和成品油市场放开改革的静态效果(亿元)

|

年份 |

福利净损失 |

政府补助 |

融资成本 |

土地租金 |

资源租金 |

垄断高价损失 |

总计 |

改革效果比例 |

|

2011 |

1405 |

81 |

634 |

524 |

181 |

4018 |

6843 |

79% |

另一方面,交易领域的市场化改革终将会对处于上游的生产领域产生深远影响,推动我国石油体制改革的最后完成。这是一个成本很低,但收益很大的改革。

改革动力结构分析表明,中国社会的大多数人将会支持石油体制改革。因为垄断不得人心,现有石油垄断体制缺少合宪性和正义性,执政党与中央政府有改革的动力,消费者和民营企业要求改革,其它中央国有企业和地方国有企业以及地方政府等也都支持改革,只有与石油垄断体制有关的行政部门与石油垄断企业的管理层与员工可能会反对改革,但其中也有大量的人支持改革。

我们在选择原油和成品油市场放开改革的方案时,应选择一条改革成本最低的道路。

原油和成品油市场放开改革的策略是:

(1)逐步放开:即如前所述,先放开原油进口市场,再放开成品油进出口市场,再放开成品油国内市场,再放开原油国内市场;

(2)体制外改革:即在开放原油和成品油市场时,保留现有垄断企业的现有原油和成品油进出口的制度安排;

(3)逐步进入:在放开市场的过程中,也可考虑分批地让其它企业进入;

(4)补贴改革:对可能出现的石油垄断企业工人的下岗甚至失业的情况,当其它石油企业的发展不能完成吸收时,政府可以建立石油产业就业基金;

(5)计划权利的交易:对于石油垄断企业整体,可以用取消对其成品油销售的价格管制,换取其接受对原油和成品油市场的放开。

我国的改革已经证明,在国有企业吸纳就业能力下降以至出现大量下岗工人的同时,非国有企业成为提供就业机会的主要力量。例如从2008年到2011年,在新增就业中,非国有企业提供了96%的就业岗位(根据国家统计局,2012)。因此,只要市场化的改革能够成功,所焕发出的非国有企业大发展所带来的就业机会,一定会多于国有企业减少的就业岗位。

由于石油的储采比上升到55,“页岩革命”将会导致石油和天然气供给的战略性增长,天然气将会在新的时期成为主导性能源;加上中国与印度的经济增长速度放缓;石油的世界市场中的供需关系将会变得相对宽松,有利于进行原油和成品油市场放开的改革。

改革时序

2013年 2014年 2015年 2016年

Basic Conclusion

The reform on opening the markets of crude oil and of petroleum products is a supporting point or lever of the whole petroleum industry reform, which involves fewer aspects, and is with less rigid comparing with the reform that touches the vested interest of the upstream industries of the oil monopoly enterprises, such as oil extraction and petroleum refining,while would get twice the result with half the effort. On the one hand, the reform can obtain most of benefits quickly from the breakup of monopoly, namely it can eliminate the losses of consumers caused by monopolistic high prices, and will eliminate the net loss of social welfare caused by the limitation on enterprise entrance. According to welfare loss caused by the monopoly in 2011, the reform would obtain 79% or four-fifths of static effects of the petroleum industry reform (as shown in the figure below), in addition, it also would increase a total sales volume of above RMB 300 billion per year due to local oil refining enterprises to increase the utilization of their capacity.

Diagram on Static Effects of the Reform on Opening the Markets of

Crude Oil and of Petroleum Products (RMB 100 million)

On the other hand, the market-oriented reform in the trading field will have significant effect on the upstream production field and will promote the final completion of the oil system reform inChina.

Thus, it is a reform to achieve quite a number of benefits with low costs.

Abstract

The economic characteristics of the oil-gas industry determine that the system of the oil-gas industry should mainly depend on the market institutions, supplemented by proper government interventions, e.g. levying fuel oil taxes, adopting short-term intervention for large price fluctuation, commandeering oil resources and products in time of war, and establishing resource reserve in time of peace.

The current oil industry system ofChinabasically reflects the three aspects: the state-owned enterprise, price regulation and entrance restriction. Thus, the oil industry ofChinahas a high degree of monopoly, e.g. two to three monopoly enterprises have integrated monopoly in exploration, mining, refining, wholesale, retail, even import and exports.

The monopoly in the oil-gas industry is an administrative monopoly, which is such a kind of monopoly established by administrative departments through issuing administrative documents. These administrative documents are not issued through due legal procedure, but they determine the affairs influencing the vital interests of Chinese people, so that they are illegal.

The current oil monopoly system and corresponding monopolistic behaviors of oil monopoly enterprises violate the constitutional principle of socialist market economy and the Anti-Monopoly Law. The reason as basis for administrative documents to establish oil monopoly right is not economically rational.

Diagram of welfare loss and distribution distortion of

administrative monopoly

The oil monopoly system has brought about a great efficiency loss in the whole society. It is estimated the welfare loss in the oil industry reached as high as RMB 3.477 billion from 2001 to 2011.

The system also distorts the income distribution and violates the principle of fairness. From 2000 to 2011, three monopoly oil companies lacked to payed profit of RMB 1470.1 billion. But in their income level, these companies are far higher than social average level, e.g. the per capita salary of the China National Offshore Oil Corporation in 2010 was about RMB 340,000, about 10 times of social average level.

The system violates the market rule and makes oil monopoly enterprises become unfair competitors. From 2001 to 2011, CNPC underpaid land rent of RMB 395.8 billion, while oil enterprises underpaid resource rent of about RMB 307.9 billion and financing cost of about RMB 287.8 billion.

The system makes an originally competitive market become a monopoly market, consequently it makes the market-based pricing system ineffective, so that the government regulation-based pricing mechanism is adopted. However, such a pricing mechanism is inefficient, causing the price it determines to deviate from the price determined by the market and will undoubtedly cause welfare loss. Meanwhile, it makes monopolists reduce their production and supply when the price is low but overproduce or oversupply when the price is high. With the quantities of production and stock in turn influence the price.

The system also directly damages other competitors including private enterprises in the following aspects: (1) to prohibit entrance, or to drive those enterprises in the industry out of oil extraction and sales realms; (2) to impose restrictions or discriminations on competitive enterprises that have already entered the oil industry; (3) to cooperate with local governments and rejects competitors through administrative powers; (4) to directly violate the property rights of private enterprises, etc.

The regulation on crude oil import has resulted in serious insufficiency of capacity utilization of other oil refining enterprises in addition to oil monopoly enterprises, so that a total loss of sales volume reached about RMB 300 billion every year.

Because the quality standard of petroleum products of China is lower

than other major countries, while the quality standard of petroleum products of

Beijing is higher than the national standard and is close to European standard

(see the figure below), We here have conducted a comparison between the

adjusted price of petroleum products in Beijing and the average level of other

main countries.

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

European standard |

European standard IV |

European standard V |

European standard V+ |

||||

|

Beijing standard |

European standard III |

European standard IV |

|||||

|

National standard |

National standard II |

National standard III |

|||||

For making the comparison more fair , we use the price before tax.

The consumption tax and actual added-value tax is deducted from the price of

petroleum products inBeijing.

From 2006 to 2011, the comparison between the prices of petroleum products inChinaand

weighted average prices in other main countries (Yuan/L) is as follows:

Gasoline

2006

2007

2008

2009

2010

2011

Weighted average of foreign countries

2.30

2.57

3.06

2.18

2.64

3.38

China

2.07

2.26

2.80

2.72

3.22

3.92

Diesel

2006

2007

2008

2009

2010

2011

Weighted average of foreign countries

2.33

2.54

3.50

2.13

2.64

3.52

China

2.15

2.44

3.03

2.95

3.51

4.25

From 2006 to 2011, the losses of consumers caused by the high monopolistic (regulated) price were as high as RMB 839.6 billion; from 2009 to 2011, the monopolistic (regulated) price of petroleum products in China (before tax) was about 31% higher than average price of main countries, so the losses of consumers reached as high as RMB 1198 billion.

Map of oil monopoly enterprises to seize profit

The system also damages national security and influences social stability. It provides the conditions and excuse for oil monopoly enterprises to create “Gasoline Shortages”, results in the tension and opposition between the central government and local governments, and damages the interests of central and western regions and minorities areas. Meanwhile, monopoly enterprises blackmail the government at a crucial time.

Finally, the system itself violates the framework of Chinese constitutionalism. Monopoly enterprises arrogate to use public power and impliment administrative power or quasi-administrative power, while administrative departments arrogate to have legislative power and abuse legal enforcement power in order to carry out the monopoly and regulation described in administrative documents.

Therefore, it is a system with significant problems, which should be reformed radically. The reform has constitutionality, validity and economic rationality.

Fundamental objectives of the oil industry reform:

5、To establish a system based on the market institutions for the oil-gas industry;

6、To form a fair and effective competitive mechanism involving the upstream, midstream and downstream sectors of oil-gas industry;

7、The government represents the state to grant the mining permiit of oil and gas to economic agents in a competitive way;

8、The government should impose limited regulations only in special fields at specific times.

Basic measures for the oil industry reform:

5、To abolish the monopoly powers and parts of administrative powers of the oil monopoly enterprises;

6、To establish an unconventional and neutral regulator for the energy industry;

7、To opening all fields of the oil-gas industry;

8、To stop the price regulation.

Diagram on the static effects of the oil industry reform (RMB 100

million)

The reform on opening the markets of crude oil and of petroleum products is a supporting point or lever of the whole petroleum industry reform, which involves fewer aspects,and is with less rigid comparing with the reform that touches the vested interest of the upstream industries of the oil monopoly enterprises, such as oil extraction and petroleum refining, ,while would get twice the result with half the effort. On the one hand, the reform can obtain most of benefits quickly from the breakup of monopoly, namely it can eliminate the losses of consumers caused by monopolistic high prices, and will eliminate the net loss of social welfare caused by the limitation on enterprise entrance.

The price of petroleum products will lower to the international level of the petroleum products with the same quality, which will benefit consumers. According to the data during 2009 to 2011, the prices of both diesel and gasoline inChinacould have been reduced by about 31%. So if the consumption is the same with 2011, consumers could pay less RMB 401.8 billion each year.

Even according to the price of petroleum products in the trading center beyond the current monopoly system ofChina, the price will also decrease after the markets of crude oil and of petroleum products are opened. It can be seen from the figure below that the price of 93# oil in the trading center of the Yangtze River Delta is about 13% lower than the regulated price by the National Development and Reform Commission.

Comparison between the price of 93# Oil generated in the Trading Center of Yangtze River Delta and that issued by National Development and Reform Commission (from February 16, 2013 to March 21, Yuan/L)

According to welfare loss caused by the monopoly in 2011, the reform will obtain 79% or four-fifths of static effects of petroleum industry reform (as shown in the table below), moreover, it will increase a total sales volume of above RMB 300 billion every year due to the increase of the capacity utilization of local oil refining enterprises.

Static effects of the reform on opening the markets of crude oil and

of petroleum products (RMB 100 million)

Year

Net welfare loss

Government subsidy

Financing costs

Land rent

Resources rent

Loss caused by

monopolistic high prices

Total

Percentage of reform

effects

2011

1405

81

634

524

181

4018

6843

79%

On the other hand, the market-oriented reform in the trading field will have significant effect on the upstream production field and will promote the final completion of the oil industry reform inChina. Thus, it is a reform to achieve quite number of benefits with low costs.

The analysis on the reform motivation structure indicates that most of people inChinawill support the oil industry reform. Since the monopoly is unpopular and the current oil monopoly system lacks constitutionality and justice, the governing party and the central government have the desire to reform, meanwhile, consumers and private enterprises are asking for a reform. Besides that, other central enterprises, local state-owned enterprises and local governments all support the reform. Only those administrative departments connected to the oil monopoly system and the managements and employees of oil monopoly enterprises may oppose the reform, but most of them still support the reform.

When we select the scheme for the reform on opening the markets of crude oil and of petroleum products, we should choose a way with the lowest cost.

The strategies for the reform on opening the markets of crude oil and of petroleum products are as follows:

(1)Gradually opening: as described above, the markets should be opened in the order as fellows: the crude oil import market, imports and exports markets of petroleum products, domestic market of petroleum products, and domestic market of crude oil;

(2)To reform outside of the system: to remain current institutional arrangements for the monopoly enterprises in importing and exporting of crude oil and petroleum products while the markets of crude oil and petroleum products are opened,;

(3)Gradually entering: during the process of opening the markets, it would be considered to grant enterprises other than monopolistic ones to enter the markets group by group;

(4)Subsidying reform: for possible laid-off or even unemployed workers from oil monopoly enterprises, if other oil enterprises can not absorb all of them, the government can establish the employment fund for oil industry;

(5)Transactions of planned rights: for all oil monopoly enterprises, the government can abolish the price regulation on the selling of petroleum products to exchange their agreement on opening the markets of crude oil and petroleum products.

The reform inChinahas proved that when state-owned enterprises can’t absorb so many workers and even bring about large quantities of unemployed workers, non state-owned enterprises have become the main force in providing job opportunities. For example, from 2008 to 2011, among all new employments, non state-owned enterprises provided 96% of employments (according to the data from the State Statistics Bureau). Therefore, if the market-oriented reform can be successful, it will arouse the prosperity of non state-owned enterprises and create numerous job opportunities, which will be certainly more than the decrease of job opportunities of state-owned enterprises.

Because the oil reserve-production ratio rises to 55, "Shale revolution" will lead to strategic growth of oil and natural gas supply, and natural gas will become the dominant energy in the new period;in addition, the growth rate of economies would slow down in China and India; the supply and demand relations will become relatively loose in the world oil markets, which is conducive to the reform of opening crude oil and refined oil markets.

Time sequence of the reform

2013 2014 2015 2016